Saudi Arabia opens its stock market for foreign investors: A brief insight for (bio) energy investors and market participants

Saudi Arabia plans to fully open its stock market (Tadawul) to all categories of foreign investors, regardless of their place of residence, from February 1, 2026. This opens up the stock exchange, which is home to a number of some of the biggest and most exciting energy companies, to retail investors – at least on paper.

Until now, direct access to the main Saudi market (TASI) has been heavily regulated and mostly reserved for so-called "Qualified Foreign Investors" (QFIs) – primarily institutional investors. As a result, with the exception of Saudi Aramco, many of the numerous Saudi energy-related companies are completely unknown to retail investors, despite their size.

Interestingly, the stock market is opening up in the midst of the transformation towards Saudi Vision 2030. Vision 2030 is an important target for Saudi Arabia's economic and social development until 2030. Vision 2030 focuses on the private sector, whose contribution to GDP is to be significantly increased. Small and medium-sized enterprises (SMEs) are also to be promoted in order to increase their share of GDP.

But that's not the whole story. Vision 2030 is particularly exciting for energy and bioenergy investors and bioenergy companies. Saudi Arabia produces millions of tons of municipal, industrial, and commercial waste every year. For decades, most of it ended up in landfills. But under Vision 2030, waste is no longer seen as a problem, but as a green energy resource. The waste-to-energy (WtE) industry is at the heart of this change. With billions of dollars earmarked for renewable energy projects, WtE offers lucrative opportunities for foreign investors and local companies in the areas of power generation, recycling, and clean energy innovation. The National Center for Waste Management (MWAN) is heavily involved in the transformation process. Saudi Arabia's transformation goes beyond sustainability. It is about creating a circular economy, reducing dependence on landfills, and turning waste into valuable resources. Saudi Arabia's Vision 2030 and the Saudi Green Initiative have set ambitious goals for waste management and bioenergy:

- By 2035, 82% of municipal waste will no longer end up in landfills.

- By 2030, up to 3 GW of electricity will be generated from waste-to-energy plants.

- Promoting private sector participation through PPP (Public Private Partnerships) models.

- Transforming cities such as Riyadh and Jeddah into smart green centres.

This transformation opens up new opportunities for global and local players in the WtE ecosystem.

Status quo and industry patterns

So much for the near future and the transformation plans it contains. Let us now turn our attention to the current situation and the Saudi stock market and economy that is still driven by fossil fuels, as well as some listed companies that could benefit from Vision 2030 or at least be affected by it.

Firstly, one has to define the typical framework conditions of the energy and oil industries in general.

Oil

When it comes to the oil market there are only two benchmarks that really matter: Brent and West Texas Intermediate (WTI). Brent Crude is the benchmark used for the light oil market in Europe, Africa, and the Middle East, originating from oil fields in the North Sea between the Shetland Islands and Norway. West Texas Intermediate is the benchmark for the U.S. light oil market and is sourced from U.S. oil fields.

The oil market is one of the backbones of the global economy and typically characterized by 3 things:

cyclicality, historical patterns and geopolitical premium.

Cyclicality: The oil market follows a classic investment cycle. High prices lead to massive investments. Since it takes years for new fields to start producing, there is often an oversupply just when demand is falling – and prices plummet.

Historical patterns: Oil prices often follow historical patterns. A striking example is the crash of 2014 (global oversupply due to booming US shale oil, while OPEC did not slow down production) or April 2020, when WTI futures briefly traded at negative prices. Historically, the oil price always returns to its production costs (mean reversion).

Geopolitical premium: Since a large part of the reserves are located in politically unstable regions, oil stocks often include a "risk premium." Decisions by OPEC+ (especially Saudi Arabia) act as a lever on prices.

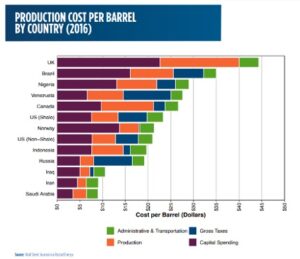

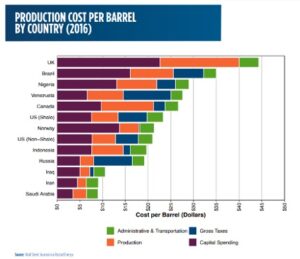

According to the 2021 Publication "Petroleum Watch" by the California Energy Commission Saudi Arabia can produce a barrel of crude oil for about $10 or less, whereas the US can produce the same quantity for between $20 (Non-Shale) and roughly $23.5. The price advantage is therefore enormous.

Energy

Utilities (E.ON, NextEra Energy, etc.) are often considered "bond proxies" on the stock market.

Interest rate sensitivity: Since energy suppliers are very capital-intensive and take on high levels of debt for infrastructure development like grids and power plants their share prices usually suffer when interest rates rise.

Energy price sensitivity: Due to the capital intensity of the industry, the payback periods for investments and margins depend on the price of electricity. High prices ensure rapid payback and a quick return to profitability, and vice versa.

Regulation & dividends: Earnings are often regulated by the government or secured by long-term purchase agreements. This makes them stable dividend payers. Historically, they have been "safe havens" during recessions, as electricity is always consumed. But one has to keep in mind that industrial electricity consumption can and often will decrease in times of a weak economy due to decreasing production.

Interestingly, even though being a fossil fuel-driven economy, due to Vision 2030 a structural change is happening in the energy sector. Saudi Arabia is heavily investing in solar and wind energy, aiming to generate 50% of its electricity from renewables by 2030. In 2023, Saudi Arabia's renewable energy production capacity had more than tripled to over 2.2 GW from 700 MW in 2022, with over 21 GW of projects under development

The Saudi state still plays an interesting role in the Saudi stock market and the economy as a whole, even though this is set to change with Vision 2030.

Currently, the state is directly and indirectly the dominant player in the Saudi economy and is regularly involved as an anchor investor or majority owner. This is the case, for example, with Saudi Aramco, SABIC, and the Saudi Electricity Company. In addition, there is the PIF (Public Investment Fund). It is Crown Prince Mohammed bin Salman's most important tool for restructuring the economy. It acts as a kind of "super holding company" for the state. The PIF is the largest single shareholder in almost all large listed companies (banks, telecommunications, petrochemicals).

However, if Vision 2030 can be successfully implemented, state involvement does not necessarily have to be a disadvantage, because who else but the state—if it is serious about it—could incentivize such a change and implement it with the help of the private sector if everyone pulls together?

Tadawul - the stock market

Finally, we take a look at companies listed on the Tadawul that (bio)energy investors or entrepreneurs should be aware of.

1. Saudi Arabian Oil Company

Saudi Aramco (Saudi Arabian Oil Company) is one of the companies listed on the Tadawul stock exchange. The company is responsible for the largest known oil reserves and the largest daily oil production, operates the world's largest gas network, and is also a leading company in the energy and chemicals sector, going beyond pure oil production.

2. Saudi Basic Industries Corporation

Another exciting company for energy investors is Saudi Basic Industries Corporation (SABIC). SABIC was founded in 1976 to enable the processing of natural resources, particularly oil and natural gas, within the country. Other mining products were added to this.

3. ACWA Power

Energy investors may also wish to take a closer look at ACWA Power. The company develops power plants for conventional and renewable energies as well as seawater desalination plants, with 110 assets in operation, construction, or advanced development across 15 countries. According to their website, ACWA Power's portfolio, with an investment value of USD 114.6 billion, can generate 93 GW of power and produce 9.3 million m3 /day of desalinated water.

4. Saudi Electricity Company

Saudi Electricity Company (SEC) is considered the primary source of electricity in Saudi Arabia by producing, transmitting, and distributing electricity through an extensive network covering all parts of the country. SEC states it will support Saudi Arabia's ambition to achieve net zero by 2060. The company is investing in grid interconnections to increase the proportion of renewable electricity on the grid. However, according to sources, in 2022, renewables accounted for a mere 0.00005% of the company's total electricity production.

5. Arabian Drilling

Arabian Drilling is an onshore and offshore gas and oil rig drilling company in Saudi Arabia. AB owns 42 onshore drilling rigs and 12 offshore rigs.

6. National Gas & Industrialization Co.

National Gas & Industrialization Co. is operating in the field of Liquefied Petroleum Gas (LPG) in the Kingdom of Saudi Arabia. The activities of the National Gas and Industrialization Company (GASCO) include filling and marketing a mixture of Liquefied Petroleum Gas, conducting wholesale and retail sales of metal and iron pipes, and managing the sale, transportation, distribution, and marketing of filled and unfilled gas cylinders and tanks on a wholesale or retail basis.

So much for some of the companies one should know about.

However, the euphoria needs to be tempered somewhat for the time being, because although the regulatory hurdles on the part of Saudi Arabia are (probably) falling, access for investors depends on the brokers. They must first provide the appropriate (reliable) interfaces to the stock exchange in Riyadh.

In addition, it could also take some time before balance sheets and key figures are rewarded with the corresponding confidence of the international capital market. The same is true for economic growth figures like the GDP.

The close ties between the state and the private sector could also be viewed with suspicion. Some of these concerns could be alleviated by the implementation of Vision 2030. However, this is not guaranteed. The Saudi economy, and thus not least the Saudi state, therefore has a duty to build trust and prove its economic performance in direct competition with other companies on the capital market.

An exciting scenario.